tv The Willis Report FOX Business January 5, 2013 2:00am-3:00am EST

2:00 am

closer watch on government. this by select -- bicyclist went into a cop but then the camera vv v. -- reveal the truth. these people could show a chord spend your money in repulsive ways and many watched the video and before "the new york times" ran a single story about the scandal congress moved to stop giving acorn your money. >> i have co-sponsored the bill to stop funding the reprehensible enterprise. john: the private digital currency to buy what government does not want you to. i do not suggest you buy illegal things but choice is good. it is freedom 0. it gives more options and makes a harder for government to control. that is a good thg.

2:01 am

that is our show. thanks for watching. >> have you checked your paycheck? it was less and give before we were saved. the fight of one upstate new york town could have sweeping the runovers -- owners. welcome to "the willis report." >> hello everybody the debt is ballooning but economic recovery is full of hot air. the month of december when the to 55,000 jobs were created but the national debt grew 780,000 times faster. we have former governor

2:02 am

huckabee. welcome back. happy new year. we are racking up $16 trillion in debt but it is $129 billion that is unbelievable. >> $50,000 per second we are racking up. the most adventurous shopper could not spend that money in new york matter how high -- hard they try. it means every man woman and child who breathe american air each o $50,000 to pay off. it hurts the economy and

2:03 am

jobs and long term future of america. gerri: congress and will not cut spending but raise taxes >> you can't. all the taxes will run the government for about eight or 10 days. it is the president to stand on the necks of those surveyed money and say you have to pay more. it will not affect the budget or the life style as much as what they will do to create new jobs. but they won't because they don't kn how much they will be asked to pay their fair share. tell me a percentage. fe will not do it. right now the average person

2:04 am

will pay almost 44 percent of federal taxes and including state or local. how much is enough? gerri: here in new york city will local taxes and real estate it is almost that 60 percent. succession dollars going to3 government it is almost too much to take. talk about the do nothing congress. the debt ceiling and this week people are getting paychecks for the first time. >> people will be surprised the president said if you make less than $250,000 you will not pay one dime. they are paying a lot of times. making $50,000 will be on th hook of additional

2:05 am

$1,600. you don't have that to give the government so they can waste it to borrow more money. it will hit people hard. ha and then add the obamacare tax and the economy will be in a world of hurt. gerri: maybe there is a tax revolution. people may make calls to congress. who knows? >> i do think therwill be a revolt from people who voted for obama that would only hit the nasty rich people. but it will hit them. in and they lose their jobs because the rich guy cannot keep people on the payroll

2:06 am

is pay the government or keep the employee. he makes the decision about the employee but not the taxes or he goes to jail. gerri: we had jobs numbers today. 155,000 jobs were created. that is so unimpressive. if we don't create 240,000 jobs we cannot keep up with the number being born and the workplace. so many people have quit looking and the government wants to give them an additional amount of time. i am sympathetic for those who cannot find work but not for those who will l because the government continues to pay them 99 weeks.

2:07 am

two years of pay for not working it will be hard to work again. gerri: i agree. the government also wants to mint a platinum coin worth $1 trillion. >> w not? that is a brilliant idea to inflate the currency. the idea is to avoid the debt ceiling fig so if you use that as the basis to borrow the new to say you are solvent. anybody with the iq above occoli should understand if you mintea clean that is utterly worthless other than you say so and that is the basis to borrow money, the only people crazier are those who let

2:08 am

america barr wrote off the point*. gerri: people will stop believing your promises. not only the american people what to give them down the road. >> the government cannot just keep giving things i wish we would replay this speech by president kennedy. he is a democrat but he clearly said as part of the vision ask not what to your country can do for you but what you can do for your country. we need to raise americans to believe their responsibility is what they can do for their country. not sit and see what can my country do for me? gerri: governor cut to me it is a pleasure. you can hear much more by tuning in to his show

2:09 am

weekend's 8:00 p.m. eastern on fox news. more on the jobs report coming up. the new congress passes a bill approving $10 billion of aid for superstar sandy that is the first of two relief measures making their way through congress. nine point* seven through the national flood insurance program was due to run out of money next week. currently 115,000 claims and 5,000 from other floods. the governors of new york and new jersey say it is said could start and governor cuomo and governor christie say it is a downpayment with the aid that the senate approv i hope they get rid of the pork speaker johnboater the inner pulled the bill.

2:10 am

2:13 am

2:14 am

but, can the county with all public information? joining me now, foxis legal analyst d criminal defense attorney and former prosecutor, jeff cold. welcome. great to have you. all start with you. in the newspaper, the putnam county newspaper turned down what is essentially the freedom of the formation request. >> well, if it's because of privacy concerns are six concerns, there are exceptions to the freedom of information act. i don't know whether they sure are not, but can they if they're right about the decision? gerri: there are people out there saying there is no way they can turn this town. you have to respond to the press request if you have the information. >> were not talking about sex offender if retire talking about sex offenders to my would agree with you, i ould implore the newspapers to publish those addresses because that is a public safety issue. but now here you're talking about folks that are liensed to have caught permittedo have a gun. this is completely legal.

2:15 am

so it's almost a safety issue, certainly a privacy issue, but i would argue a safety issue for those folks of their names are out there. gerri: that sam apparent and i have kids and there's a play down the street. maybe the folks i knew the neighborhood in a more reid. i want to know if it is again in the house. should not have access to that information. >> i think you should. the thing about it, think about it this way. i buy a gun for protection. i probably want to pay extra so the publish in the paper i have a gun so that everyone know, i have a gun, stay away from the. on burglarize my house. gerri: you think that is information you want to have out? people who have guns don't want that affirmationout. >> why? why he won aain? for protection. >> let's say i'm a woman who has been abused by a former husband, not only do i not won and to have a gun, and anyone to know where i am. now you publish not just the fact that i have a gun but my name. >> the only reason.

2:16 am

let me go back to your plate. the mom, dad. that's one way to find out. but the other thing, to put a name out here they've done nothing unlawful. to have been exposed like that to malign. >> you might go back to the ds. on worriedabout people having a road map to wear every gun is if they're want to steal a gun. that is the other concern. including the kids. every kid who has a laptop will then know where every gun is in the neighborhood. so there are two sides to the issue. they need to clarify t law properly to make it very clear. gerri: wait wait wait. what you talking about clarified. come on. there's nothing to clarify. >> everything should be under the sunshine,open public records alas, and that is the well law is written with exceptions. they should be very clear. gun permits may be should be a exception. maybe you don't want people to

2:17 am

know about that. >> public safety, all of those things are exceptions, and i can certainly see. we have done nothing wrong. you are abiding by a lot to get the permit. what the fbi know if you have a gun, the atf to know. gerri: there is information i share with the government. i file a tax for every year, every financial detail of my life is in washington d.c. that doesn't mean they should be able to share that. >> that's privacy. that's not released. again,ou have to show what the harm is to smebody knowing i have a gun when the whole point of having a gun is to publicize the fact, stay away from the. >> i don't know that that's necessarily the point. >> you going to ambush somebody. no. >> that does not mean that every public document is open and can be turned out to the public. there are exceptions,and i think in this case the made a wrong decision.

2:18 am

gerri: another argument being made. and that's this. the newspapers, you ow what, they're trying to sell a few newspapers out there. th is publicity. they're getting a lot of attention. and sort of taking advantage. what you say? >> that's what newspapers do. they sell papers. is that illegal? now. is that an illegal use of open public recos. gerri: does it give your reason? >> what i say is what is the harm in knowing where the guns are. add all see the harm. gerri: i see a lot. worry about people being been pointed. >> that they have a gun, but they have a gun. >> you might be crazy. don't let your kids go there. they have begun. your talking about permit holders have done nothi unlawful. sex offenders, have them lited. all of that. but rifle gun owners. gerri: absoluty a safety issue

2:19 am

>> if this is a big issue the legislature makes it clear. to release th information. >> at like to say we have settled this. gerri: we haven't. thanks you for coming on, both of you. appreciated. great conversation. i feel edified. coming in, the atest of report gives no indication when the unemployment rate will begin to fall. are we entering a new economic phase? and if you thought the last congress was bad, aren't they? destroyed until you hear what is on the agenda for the new congress. i'll break it down next. c, afc, offensive lineman, defensive tackles, quarterbacks and cornerbacks are all working with united way. for a million little reasons. the kids of our communities. to ensure their academic success, all the way to graduation day. it takes about 12 years to create a graduate.

2:20 am

it takes the same time to create a dropout. and the difference between a kid becoming one or the other could be professional athlete. or it could be you. studies show, the earlier we get to kids, the better their chances. so become a united way volunteer reader, tutor or mentor. make a difference in the life of a child. for the life of that child. give. advocate. volunteer. live. united. join your favorite nfl players. take the pledge. go to unitedway.org.

2:21 am

2:23 am

gerri: how you glad the fiscal cliff is over? i have to tell you, more of the same to come. kent ratiol wrangling, likely more rate -- name-calling, pushing the decision making to th24th hour and beond. here's the calendar of events. sequestration. this is that 600 billion in tax cuts in the defense department. congress was supposed to decide what to do about the linacs, but it has not done anything at all except the can down the road for another to months. spec that conversation to kick into gear late next month. and then the debt ceiling. democrats won permission to spend more money in march. congress has the constitutional authority to set our debt ceiling and has agreed to raise it. watch for a big fight as republicans try to institute some sort of fiscal sense that democrats resist. the big events, but there is

2:24 am

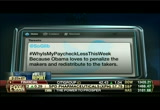

another one that happened today that congress did not pass a resolution to recognize that happened. you probably already know about it. the payroll tax has expired, and if you et your first paycheck today says the fiscal cliff, well, watch out. you may be shocked by then nearly 50% increase in the tax. the social security withholding tax reset. for middle-class american families earning $50,000, that means at least in $800,000 tax hike, maybe as much as a thousand bucks. if thi is the first shot of about, it's not going over too well. here's what people are saying on twitter. if you're asking why my pacheck is less this week, is because you got what you asked for. on it. why is my pacheck bless thi we? because obama loves to penalize the makers and redistribute to the takers. it gets worse. on and on andon. my prediction here is there is

2:25 am

no attempt to curb federal spending, will have to raise taxes agn and again and again on me and everybody else. that's going to be the new normal cong up, we are not just dealing with the federal tax hike. most american side and the paychecks. what about state and local taxes. what to expect. more on today's not so hot jobs report. will this be the ammution republicans need in their debt ceiling fight? coming up next. it was the biggest race of the year, and no matteoqat, i was gonna win. someti[js...things happen you just canoi explain.

2:26 am

)a ♪ oh, i believe there e angels amongs... ♪r> and some things ar more importanthan winning. #% ♪ sent iíwn to us #]from somewhere up(ove ♪r2 #o♪hey me to you and me ♪ i don't remember who won the ra that day...r2 ♪ to show usfr how to live, ♪ ... bui'll(never forget how i felt. ♪ to teach us f:how to give ♪ to guide us with the light of love. ♪

2:28 am

2:29 am

british hospital. officials say she is strong and recovering well, so she will have to be readmitted next month for another round of surgery to rebuild her skull. as we told you, she was shot in the head by muslim extremists for promoting groth and education in her own contry. she will live with their parents and o brothers in the u.k. was a continues to receive treatment good news. meanwhile, the jobs report showing the slight growth. not really moving the economic neil. presence dollar an american enterprise institute and former consultanto the treasury department and steve son, president of capital public affairs and a former labor department official. all-starith you. where can i get -- what you make of this report? >> 455,000, which was the jobs increases, the average for the past couple of years. what is really sriking about this is this is the best we will e for a while.

2:30 am

gerri: what? >> yeah. normally at the start of the year we're looking at big stimulus. last year payroll tax cut help fr the fed. on average since 2008 the stimulus of the srt of the year has been three and 55 billion. this year its-270000000000. so we go from of big tailwind to a big head wind. this isthe best numbers we can do at this point, wait until those tax cuts, people and get their payroll, thir paychecks. gerri: let's let steve and then. do you agree. >> i think it's pathetic. the economy really is treading water. we have te most lackluster recovery since the great depression. clearly the president's policies are not doing what they're supposed to be doing. a lot of clients, small business people a petrified with no idea, no idea whatsoever with regd

2:31 am

to up how to planfor their businesses to what taxes will be, what health care will be. afraid to hire anybody. this is not a good situation. the economic engine has always been small business. a small businesses are hiring them we have a bad situation going on. gerri: you guys are saying this is a terrible report. but what is interesti about that is i think a lot of people thought that, you know, maybe this looks better than it actually is because of hurrine sandy. a lot of special things happened this month. u're saying it'worse the more we're seeing. >> there were some special things that made it better. sandy, the weather in december was warmer than usual. that always gives a little boost in its construction. hundred and 55,000. an uptick in the unemployment rate. as i say, as the best we will see. you really have -- you need all the help he cod get today, but it's not going to be there.

2:32 am

>> are shocked by what you say. one of the things we have been following all along, labor force participation. not a big change, but really disturbing the trend. what do you think. >> i agre lackluster holidayseason. the estimates were don over last year. people don't have the confidence to purchase anything. you're looking at treading water this is not good. gerri: let me ask you about labor force articipation. a lot of people say this is just baby boomers retiring. >> don't think so. i thinn a lot of baby boomers are struggling right now because they have seen a lot of their income and savings goal weight. the housing market, for example, has been a terribly. a little bi of growth. this is a terrible situation that goes very deep into the economy. we need leaders in washington right now. we need policies that will take us out of whe we are. gerri: i was hoping not to get to a political conversation, but it does lead the way.

2:33 am

i wt to ask you about the federal reserve, the target ra. you ow, the fed was just talking this week about ending some of their spcial support of the markets this year. the stimulus money is going away, the federal reserve support would go with the markets. queasy the jobless rate coming in? >> if you move slowly by the middle of the year it will be in the eights and probably by the end of the year close to nine. they're going to do some qe. everybody knows that. it's already. maybe those stop. which they won't do. >> business in america has a lot of cash. the problem is getting them to invest. and they are afraid to invest. so uncertain about the future. they don't know what tax policy

2:34 am

will be, what health care will be. afraid to hire more people. in that situation i don't see changing all. gerri: to tht point, we have the debt ceiling looming. if we were to find a solution for the debt ceiling from whether it makes democrats or republicans happy, we have some kind of resolution on the fiscal cliff. if we were to do the debt ceiling and take care of sequestration, do you think employers will start hiing? >> the best we could do would be to come up with a credible long-term plan. gerri: credible long-term plan on capitol hill and the white house. are you kidding? >> u.s. you're right. the problem here is, between now and the end of february is everyone goin to say, well, here is a we need to do? are they going to agree on it? the republicans, i think, have corrected said we have done something on taxes. we raised it for everybody who works to raise taxes for those nasty rich folk. now cut spending in order to get

2:35 am

on a gravel path to reduce he deficit. >> we enacted the greast tax cut in american history. 25 million new jobs. the american economy had confidence in president reagan. in what direction was going to be. that is what is lacking. we need to have thatright now. >> you go back. you have to go back to reagan, george bush. employment rate at 5%. five unchanged. people would be shocked to think that now. let's talk about this a little bit. people think of this as normal. that's about what the economy should do. your response. >> people who have jobs think of as normal, but the once you don't don't think of as normal, and the people who are going to look at their payhecks to the people look at their paychecks today will say, wait a minute. i thought we were going to get tax increase. unemployment is staying up. what's so great?

2:36 am

>> it's unacceptable for the american people to accept anything out of washington and all. it's unacceptable. gerri: i love that and agree. i want to thank both of you for coming out tonight. thank you so much. interesting analysis. christoph. while the national jobs report was simply not pectacular , unacceptable, some cities actually seeing a big boost in jobs. for them 2012 is really pretty good. those cities make up tonight's top five. gainesville, gergia. they added 4500 jobs last year thanks to increasing manufacturing activity ad a prbusiness climate. the unemployment rate is only 6%, well below the national average. number four, in my home state rocky mountain north carolina, the unemployment rate is really high, down considerably from the 14% rate. the percentage of people employed is up five and a half% thanks to an increase of 3400 jobs.

2:37 am

mississippi -- let's say that one more time. they added 13700 jobs, mostly in the mining, logging, and construction sector, but the unemployment rate is eight and a half%. here's the surprise. way out in the mountains. this city has set a bom recently. in the middle of 2012 the employment rate was over 7%. it is down to 56%, mostly due to hiring searches at virginia tech university. and the number one city anthe most jobs is lafayette louisiana they boosted employment in the city by nearly 10%. the and plumbing rate is just about 4%, 1 of the lowest in the couny. already seen a big pickup in tourism. most of the new jobs, and the restaurant and retail industries. the big loser, where it -- losing three nap% of their

2:38 am

2:41 am

♪ gerri: many state and lcal governments seem to be starting of 2013 on the right fincial foot compared to just a few years ago. some people say hat, but joining me now, a senior fellow at the manhattan institute. he is the author of shakedown, the continuing conspiracy against the americantaxpayer. okay. read a story summer about how states are doing a better job managi the money.

2:42 am

slightly better physical condition, but you say not so much. >> emphasis on slightly. basically what happened is a state tax collectionare going up, but after 2008 they went down for two straight years. then they stayed low. it is taking five years for the states and localities to actually get their tax collections back to where their work. the thing about that was during the five years the cost is been going up every year. peion costs, health care cost to medicaid. unemployment insurance. so what happens, the costs are appear. so -- gerri: 13,000. >> the pressure does not come of those states and localities. two-thirds of all government workers in america are employed

2:43 am

by localities. your town, schooldistrict, county. municipalities. the december jobs report that just came up today. again, government jobs down 13,000 total. most local jobs because the pressure is enormous. it's not going away. all the experts keep saying, down the road it's getting worse gerri: we just had a guest on his said we have ad all of the stimulus spending, and it is right now. it ends this year. none of that money coming through, and it's going to have local governments especially hard. >> absolutely. first of all, teeting for a very long time. 2010, beginning of 2011 which is why would ou saw is for a while. private sector jobsgoing down and public sector jobs kept growing. all the suddenness of last year. so yes, the thing is, what they have not been able to do is they have not been able to grab hold of their cost. totally out of line with one

2:44 am

another. the road government is no longer helping. on top of all that the citizens are paying higher taxes. taking money out of the private economy in states because that is where people live. sending more of that money washington. gerri: i got a look at how this impas me for the first time. i sent my coffee into the other room. >> they're going to be shocked because the social security tax was going up. every wage earner pays that. gerri: it does not sund like much, t it's a lot. >> is not to percent, its two percentage points. a went from four to six, almost a 50% icrease, 50 percent increase. two percentage points is different. we will be paying a thousand - gerr look at that. let it affect the health the top health care costs are increasing because unions have swayed over all governments. they're paying higher and higher costs across the board.

2:45 am

what gives? all i can figure, the only black in figured, cngress will not cut spendg, taxes go up for everybody again and again and again. >> i said this over and over again. >> at the state and locl level we entered into a new era where people are paying more and getting less. fewer servies happening everywhere and higher taxes. unfortunately that's he reality. this is not like past recessions . that is the reality in many places. gerri: next time you, and bring a better news. [laughter] >> okay. gerri: all right. good to see you. happy new year well, something totally different. this stay in business. guess what, the euro hit the world stage.

2:46 am

you remember this? eleven european countries can together to create the world's second largest economy with nearly 300 million consumers. it closed at a dollar. did not stay that way. the euro consists of eigt. and silver paper bills with $0.77 for every dollar. currencies replaced by the euro include the french franc, italian lira, and the german deutsche mark. for those of you curious, it was not accepted until two years later because it failed to meet all the required conditions like being solvent. they probably should have read thought that decision entirely. made its debut on the stay in business january the fourth 13 years ago today. the investors sick of other people making decisions for them they stop believing in mutual funds. the truth behind these next.

2:50 am

2:51 am

week. the mrket's extended the new year's rally. in exchange traded funds are very popular with a lot of investors or ets. they allow you to diversify over an entire market sector. here's what caught our eye. the amou of money investors pumped and hit a new record in 2012. 1,807,000,000,000. that's far more than the previous record set back in 2008. so is this for you should be investing? chief market analyst joins me now. ets, of the financial advisers like them because they are cheaper and actively managed mutual funds . you have some interesting insights into this debate. actively managed mutual fundsor just buy some sort of sector fund? use a mutual fund managers don't what you think they do. >> a lotf them don't, and in all fairness, there are many who are vy good and they outperform their benchmark index is.

2:52 am

to many of them are closet indexers. they just want to mirror the benchmark. they essentially get paid for doing nothing. gerri: let's explain. meaning they buy everything in the index. they buy the s&p 500 large cap mutual fund. it's up 14%. there up 14%. >> and they get their feet. investors to figure this out, and that's why so much money is going into the etf. gerri: does not the only reason. >> has not the onlyreason. gerri: they are cheaper. fees are tically lower. >> the fees are lower. it makes sense. investors are smart for doing that. mutual-fund managers frequently need to own so muh. over diveified said that they can really otperform. there are some who do. investors, if they buy a broad sed cts when they have exposure to the market, hopefully not as

2:53 am

volatile, but if they buy sector or even one level of work, industry group do they may be surprised to the amount of volatility gerri: here is what i like. bullish for this year. >> a tremendous amount of reasons. first and foremost toward the end of last year when everyone was worried about the fiscal cliff i saw that certain xes, small-cap, madcap, transportation indexes him and they were going to close the year at all times yearly closing highs. the nasdaq market place was going to close the year at its best level in 12 years. gerri: can argue with that. >> all these people who sold during december, now they're ying back. there is a lot -- gei: are you worried about this debate going on in washington, the debt ceiling to my defense spending, sequestration, on and on. negative impacts in december.

2:54 am

did you think those will hold the market back? >> policy mistakes and my number one concern, and that's from washington. the market here is that a very important inflection point. this could be what i call the point of recognition. valuations in the market based on bond yields verses equity yield since august of 2011 when europe was giving big problems they rose to levels never before seen which show a tremendous fear on the part of investors. right now they're back in the lower part of that range. if we can break through that it shows that investors will not be demanding as much of a risk premium as thee have been. that would be bullish for the market. i think there's a good chance we see all-time highs this year in the s&p. gerri: give me one sector name you like and then we have o go. >> i did not get compliance approval for a name, but i'm very bullish on financials and on consumers. gerri: thagives us a lot to chew over and over.

2:55 am

thanks for coming out tonight. happy new year. well, we'll be right back. the answer to our question of the day, some homeowners without flood insurance be bailed out? of give you my "2 cents more" on our real love story, anunusua wedding that will warm your heart. you're going to love it don't go away. ♪

2:57 am

john is 42. mortgage. married. two great kids. he wants to protect his family with a $500,000 term life insurance policy. what do you think it'll costim? a hundred dollars a month? sixty? forty? actually none of the above. john can get a $500,000 policy -from a highly rated insurer - for under $25 a month. his secret? selectquote. selectquote is impartial.

2:58 am

they'll search the pick of insurers like these to give you a choice of your best prices. selectquote has great savings on term life for women, too. john's wife carrie, can get a $500,000 policy for under $16 a month. selectquote has helped make term life insurance affordab for hundreds of thousands of people since 1985. how about you? just call this number or visit selectquote dot com. gerri: more than two months after superstorm sandyhead, victims were getting hp from the federal government. should people without flood insurance be getting bailed out by the taxpayers? here's what some of your posting on my facebook page. terry says why not? ago by the banks. bi says no i love this. we should only help the helpless, not the clueless.

2:59 am

we also asked on gerriwillis.com and 4% said yes, 96% said no way. a viewer from oregon says we are tired of t bs cong from washington. the country is in big trouble and no one -- noone wants to fix the problem. every one of them and their friends has their hand in the money pot and, no one wants to cut them off. people are scraping by to make a living and are scared of what is coming. >> charles from north carolina says it upsets me that our politicians politicians keep arguing aboutax increases and entitlements. social security and medicare are to think that i paid into my life. i have not heard one word from any of them about them cutting their own entitlements or pensions or heth care perks. finally, we do not have a revenue problem, we hve a spendiro

63 Views

IN COLLECTIONS

FOX Business Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11